The Magic of the Non-Budget

Let me say right off the bat that budgets can be great. Many people find success in their personal financial lives through meticulous budgeting. There are also many different types and varieties of budgeting strategies out there, so there may very well be one that will work amazingly well for your unique financial needs. None of this is intended to talk you out of budgeting if it is something that works for you.

However, I’m finding that not all people who are excited about personal finance are equally excited about traditional budgeting – myself and my husband included.

What is the Non-Budget?

The non-budget, for our purposes, means that we automatically take the important stuff off the top of our income and then spend the rest however we feel like it.

In our current phase of life, this means we aggressively pay down our debts and contribute significant chunks of money to investments/savings every. single. time. we get a paycheck. The specific amounts contributed to debts and investments are based on our own calculations of what we need to hit our long-term financial goals.

After that, we can spend what’s left in our checking account on whatever we feel like. Sometimes it’s thousands of dollars for a trip abroad to visit loved ones. Sometimes it’s $8 for snacks at a gas station. When that money is gone, we’re done spending. No skipping debt repayments or savings contributions “just this once” because we wanted to buy something else. No skipping debt repayments or savings contributions if a paycheck is lower than usual. No carrying credit card balances EVER.

No detailed budgeting.

The Non-Budget Might be for You If:

-You don’t like keeping track of details in your spending.

-You know how to have fun for $0.

-You have set your long-term financial goals.

-You know what you need to contribute monthly toward debt repayment and investment to hit those goals.

-Pulling large debits from your bank account on auto-draft doesn’t scare you.

-You have enough backbone to tell your kids and/or your friends and family: “I don’t have the money for that right now.”

-Your spouse/partner is on the same page about the above items, and you trust each other absolutely.

-Bonus points if the following image doesn’t make you want to throw up:

That’s a real screen shot from my checking account early this year. The internet, in its wisdom, immediately started sending me “need cash fast?” ads. But obviously we didn’t need cash, fast or otherwise. We were just done spending money until we got paid again.

How We Got Started

I was relieved when I realized we weren’t the only people who loved personal finance but hated budgeting. We did some math and figured out what we wanted from our money. And then we slowly started getting the money we didn’t want to spend out of sight and out of mind.

First we put all our insurance payments on auto-draft. This is what protects our health and lifestyle, so it’s non-negotiable at this point in our lives (although arguably a rip-off). Then we put our student loan payments on auto-draft. Then we put our savings/investments on auto-draft. Then we calculated what we needed to pay on our business loans to have those gone in 2020, and we automated that. It was weird at first to have so much money going out of our account without us thinking about it, but the longer we did it the more it seemed normal. At this point we can’t imagine not having all these debits automated.

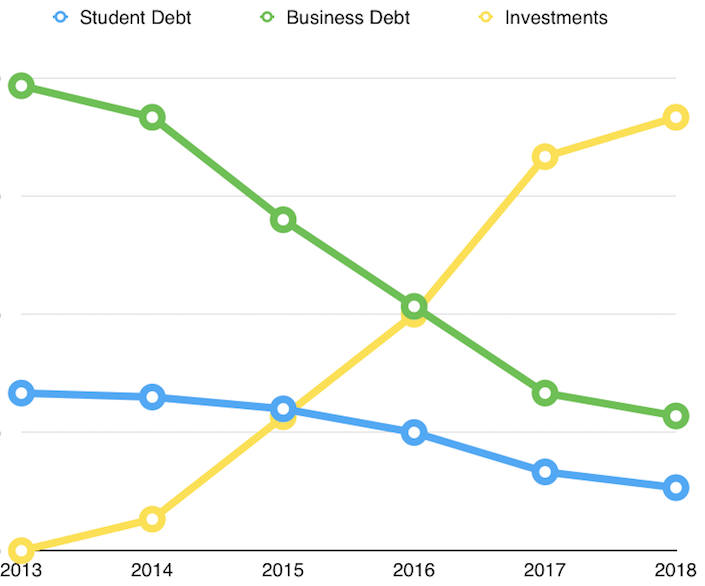

If you look at the small picture, you might be nervous for us because our checking account takes some pretty serious nose-dives sometimes due to the aggressive debt repayment/saving. We also don’t own some of the things that most of our peers own due to our self-imposed spending limits, which seems to make some people feel sorry for us (a fellow doctor recently told me: “I don’t know how you can raise two kids in the house that small!”). But if you look at the big picture, it looks like this:

This chart starts in 2013 because that’s when I finished school, and it is an approximation of our situation over the past 5 years based on the 15 minutes I was willing to spend this morning looking over our numbers (you’ll recall that I find looking at finances daily to be very tedious). No, I don’t have the guts to share with the whole internet what my debts were at their peak or what our investments are at now – although these numbers are no secret at all from those who know me.

But you get the point: that notification from my bank (or the fact that someone thinks my house is too small) doesn’t mean much to me when I know that the big picture looks like this.

Note: We are aware that our investments look like this partly because the markets have been going nuts for the last few years. We are also aware that we will owe some significant taxes on our investments in the future, so that yellow line is really not as much fun as it appears to be at first glance. But the plummeting blue and green lines are lots of fun. They should hit zero in late 2018 and 2020, respectively.

Why the Non-Budget Works for Us

We don’t like counting money on a daily basis. Counting things up monthly is doable, but we really prefer thinking about and talking about our 5-year and 10-year goals. We are big-picture people. We also know how to have fun without spending much money, so on the rare occasions that we do run out of “spending money” it doesn’t bother us at all.

I’m not saying you have to do what we do. But if you find traditional budgeting tiresome, consider the non-budget. Whatever direction you decide to go with your financial strategies, throw a graph together like the one above and make sure you are liking what you see. If you don’t like what you see, today is the day to change it.