The Financial Life of a Computer Engineer

Our guest post today is from an awesome computer engineer who agreed to share some interesting financial, schooling, work, and investment details from his life so our young people can have a real-life story to consider when contemplating career choices.

In case you were concerned that our guest-poster is a boring and out of shape nerd who spends his days indoors hunched over a keyboard, you should know that in addition to already kicking ass at personal financial management at the tender age of 28, Mr. Computer Engineer has completed over 10 long-distance running races, summited every single one of the 54 14ers in Colorado, and traveled all over the world to hike, climb, and ski. The photos in this post are his.

The Financial Life of a Computer Engineer

(from high school to projected retirement!)

Hi Everyone!

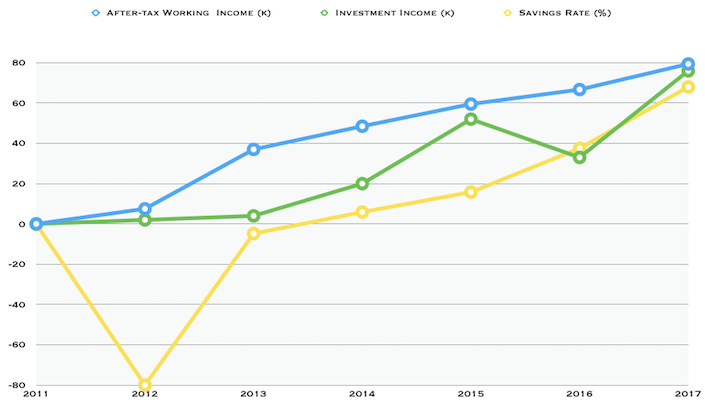

Below you’ll find my attempt at sharing my income, my savings rates, and my thoughts about my career and finances over the years – as I went through school and then got started working and investing. A few things to note:

1) The after-tax income numbers that I share below are substantially less than my actual salary in any given year. Taxes are the worst.

2) My net worth actually decreased over the years that I was in grad school, due to my foolishly youthful idea that it was okay to spend more than I was making because I had savings and no actual work of my own.

3) Despite also foolishly keeping most of my money in cash for most of my life, I managed to make a fair bit of investment income by getting lucky with Colorado real estate, flipping my own house in less than a year and selling a house I had bought with my brother for more than twice what we bought it for six or so years prior.

4) I only really got serious about investing in March of 2016. The goal now is to have almost all of my money invested and have only a small cash reserve. Impress upon your brain the monumental importance of pre-tax contributions to a 401(k) or IRA! That is what enabled my huge gains in the total value of my stocks recently.

5) Also, for reference, my job comes with 15 paid vacation days and 11 paid holidays a year, plus good health insurance for about $100/month and annual bonuses of anywhere from 3 – 10% of my salary, depending on how the company is doing. I think all of this is pretty standard for a large engineering company, but much less so if you are working at Starbucks with a BA in Art History.

My financial timeline, with income and savings rates:

2008:

High school graduation.

2008-2011:

In college at a state school on academic scholarships.

I had some money at the start of 2011 from an inheritance from my grandfather. I also had some money that was my own “life savings” to that point – from working as a landscaper over the summers in high school and not quite spending every penny of my scholarship stipend in undergrad.

2011:

~$0 After-tax Working Income (still in college).

$0 Investment Income.

Bought part of a house in Colorado.

Savings rate: Likely negative, which is terrible.

2012:

~$7,500 After-tax Working Income (graduate school stipend fall semester).

~$2K Investment Income (appreciation on CO house).

Savings rate: NEGATIVE 80% (!!!), since I spent $6,000 of my savings in addition to all of the $7,500 that I earned.

2013:

~$37,000 After-tax Working Income ($15K graduate school stipend spring and fall semesters and $22K working full-time for Seagate over the summer and part-time during the school year).

~$4K Investment Income (appreciation on CO house).

Savings rate: Negative 4.8%, since I spent $1,800 of my savings in addition to everything I earned (HUGE lifestyle inflation that year, I am just now realizing).

2014:

~$48,500 After-tax Working Income ($7.5K graduate school stipend spring semester and $41K working part-time for Seagate until May then starting full-time at an annual salary of ~$73,000 per year).

~$20K Investment Income (appreciation on CO house and some stock gains).

Savings rate: 5.9%. My first positive savings rate! Pitifully small.

2015:

~$59,500 After-tax Working Income (Working full-time for Seagate, got a promotion near the end of the year so now salary is ~$86,000 per year).

~$52K Investment Income (appreciation on CO house, a fantastic flip of my own house, and some stock gains).

Savings rate: 15.8%. Still terrible but now somehow well above average for Americans!

2016:

~$66,700 After-tax Working Income (Working full-time for Seagate, got a raise near the middle of the year so now salary is ~$89,500 per year).

~$33K Investment Income (appreciation on CO house, income from investment real estate, and stock gains).

Savings rate: 37.5%.

Started plotting for FI.

2017:

~$79,400 After-tax Working Income (Working full-time for Seagate, no raise that year but pretty good bonuses, salary is still ~$89,500 per year but got about $13,000 in bonuses).

~$76K Investment Income (appreciation on investment real estate, income from investment real estate and stock gains)

Savings rate: 68%. Fully committed to FI now! I’m only saving ~60% of my after-tax regular paychecks but saving 100% of my bonuses boosted the total percentage.

Additional notes: I bought three of my current four real estate properties in 2016. I bought one more toward the end of 2017, plus paid down one year’s worth of 15-year mortgages on the other three, plus I think they’re now collectively worth about 40K more than I bought them for (I got a very good deal on one in particular, I think, plus prices in that location went up over 10% in 2017). I do not own those properties free and clear, but have good equity in all of them and they are all consistently rented out. If I owned all four properties free and clear they’d be worth about $375K total.

Financial independence and retirement:

My projected FI date is currently December 6th, 2025, the day before I turn 36, at which point I should have a net worth somewhere between 1 and 1.2 million dollars. With some luck I might hit $1 million sooner and retire even earlier – we’ll see!

I could technically support my current annual spending levels with only about $625K in investments, which I should hit around age 31, but I figure I might as well keep working and go for a million as long as I can stand it.

Common objections:

Some objections that seem to surface constantly in the discussion about early retirement are as follows:

Your lifestyle might work fine for you now as a single guy, but what if you want to get married and/or have kids?

What about medical insurance?

What if you decide you need more income after retiring at 36?

I will assume that these objections come from a a place of honest ignorance and confusion on the part of the objectors, and not just haters hatin’ as they tend to do.

To the first point: As mentioned, my current single guy lifestyle costs me only ~$25K per year, whereas the $1-1.2 million I intend to amass would support $40K – $48K spending annually, which is 60% – 92% above my current levels of spending. Even assuming my hypothetical wife is destitute and has no ability to produce any income whatsoever of her own (which appears to be the questionable assumption inherent in such a question), my investments could easily support us both. And if I want to have kids, I have the most excellent Doctor in Denim blog to show me how to do that without spending a fortune.

To the second point: I expect my health insurance costs to increase when I retire, though I expect the increase to be offset somewhat by a decrease in my costs of living, since I currently live in one of the most expensive counties in the country (thanks a lot, Boulder!) and would promptly move away once I retire. Also, since I would only withdraw income from my investments commensurate with my spending (~$25K per year) I’d qualify for subsidies under ObamaCare, assuming it or something like it still exists when I retire. (Who knows, we might even have universal healthcare like every other 1st-world nation by then! Though I’m certainly not counting on that.)

If I decide to go full-on world traveler, global health insurance policies are actually very reasonably priced since only healthcare in the US is insanely expensive, and to get a global health insurance policy you must prove that you live in the US less than half the year. If I really wanted to, I could even move to somewhere with universal health care (for example, ANY other 1st-world country!)

And again, my investments will support significantly higher spending even if my healthcare costs climbed dramatically for some unforeseeable reason.

To the third point: Given that I already travel internationally every year and domestically almost every weekend and have entirely too many possessions, it seems unlikely that I’d decide I needed even MORE money. What on Earth would I spend it on? Still, sometimes unexpected expenses do arise, so I have planned for this contingency as well: since my investments will be generating between $15K and $23K more than I plan to spend each year, those sums will be continually re-invested, and each year I’ll be able to withdraw even larger sums while continuing to save the same amount if I so chose (even adjusted for inflation).

For example: saving and investing an extra $15K at 7% interest for 10 years gives me another $216K by the time I’m 46, which would support an additional $8,600 in annual spending, inflation adjusted, forever. If I kept saving that extra $15K until I turned 66, I’d have over $1.5 million, on top of the $1 million I had when I retired! Saving $23K per year obviously would give me even more, but honestly, isn’t $1.5 million dollars that I didn’t have to lift a finger to generate enough?

(Note that none of this even takes into account the fact that if I work until age 35 I’ll qualify for social security when I reach my 60s. Maybe it won’t be around, so why count on it? If it happens to still be solvent enough for me to collect the benefits I’ve been promised, it’ll just be a bonus.)

And finally, if I really, truly desperately needed more money for some reason, I could always briefly go back to work until I had obtained said money. But I doubt that will ever be necessary.

The key theme in the answers above is adaptability. Being financially independent means that you have way more options to solve any given problem than someone tied to a job, not less. I have planned for virtually all foreseeable circumstances, but if the circumstances change dramatically, I can easily change my plan.

Additional notes for those thinking about computer engineering:

If I had to do it all over again I would have just gone straight into working after college rather than go to graduate school; my Master’s degree is not terribly useful. I obviously spent a ton of money those two years when I could have been earning money instead, plus I’d be two years further along in my career now. So my point is: more schooling is definitely not always the best choice. And also: your savings rate is critical.

Good luck to all!

Love, Mr. Computer Engineer

A quick comparison to doctoring:

Hi guys! It’s Dr. Peppers again. Now don’t get me wrong with this comparison thing – I love what I do! But I’ve always found it really interesting to compare my journey as a doctor to other people’s career choices, and to look at how that plays out over time. So let’s make some massively generalized comparisons!!!

At 4 years out of college:

If you are a doctor with a DDS or DMD degree: you just finished dental school (average debt $287.3k), you have the option of residency. Average salary without residency is $149k. Residencies may pay, cost $0, or cost tens of thousands of dollars. Average salary of specialists seems to have a wide range with averages being around the mid-$200k range.

If you are a doctor with a MD or DO degree: you just finished medical school (average debt $166.7k), residency is basically mandatory. Average resident salary $55k (for ~3-7 years after med school). Income after residency has a wide range but seems to have an average around $235k.

If you are an average computer engineer: you have been out of school for 2-4 years, depending on whether you got a Masters. Your student loans are low or non-existent, due to the fact that engineers as group take our less student loans than any other major. Your salary for the first few years of your career was around $70k-90k. Your average salary in a few more years will be over $100k.

If you are Mr. CE: You have no debt, $52k in investment income, $86k salary (total income of $138k) at age 26

At retirement:

If you are a dentist: you are 68.8 years old.

If you are a medical doctor: you are 65-75 years old.

If you are an average computer engineer: you are 55-60 years old.

If you are Mr. CE: you are 36 years old.

So there you have it. I think the bottom line is this: when your kids tell you they want to “play on the computer” for their job when they grow up, you should probably tell them “Excellent plan! Go work on your coding.”