Paying Off Our First Rental Property

How We Got Here

We’ve always had real estate as part of our retirement plan. It’s a constantly-evolving vision, as most long-term plans are. The property we just paid off is in the Chicago area and was purchased by my husband in the mid-2000’s on a 30-year mortgage.

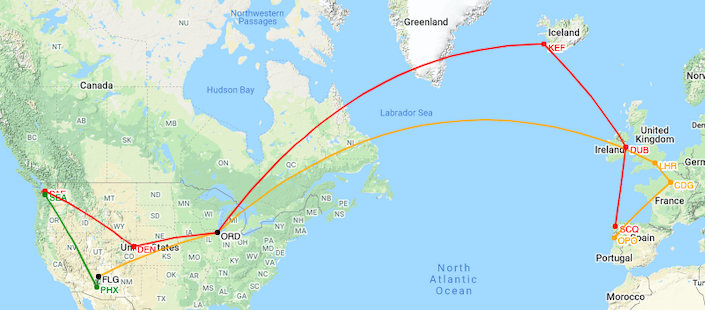

We met in early 2010, and a year later we had decided to get married and move across the country for school. Selling the property at that time would have made zero financial sense, with the housing market still in its Great Recession death spiral. We signed on with a rental management company, packed our cars for the West Coast, and became long-distance landlords.

…