Goodbye, Student Loans!

In February of this year, I made some calls to the lovely folks at the Department of Education and Student Aid and confirmed that from 2005 to 2013 I took out almost $350,000 IN STUDENT LOANS!

A Brief History of My Loans

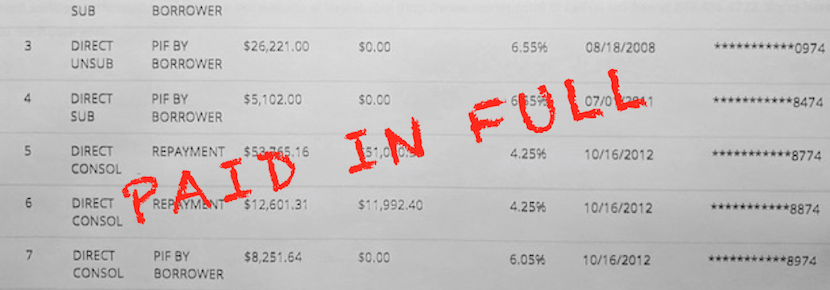

The exact total amount of money I borrowed for school – including tuition, fees, supplies, and “cost of living” funds – was $347,634.

That total is principal only and includes none of the interest accumulation, which was quite significant over the course of all those years.

The loans were dispersed between 2005, when I started dental school, and 2013, when I finished my specialty residency.

I had no debt coming out of undergrad, which I finished in 3 years at an in-state university. I got an academic scholarship and worked two jobs during college. And before that I went to a public high school and worked at a bakery, in case anyone is keeping score.

My First Years of Doctor-Level Income

After my first year of speciality income, I paid tens of thousands of dollars just in INTEREST (not a typo) on my student and business loans, and something clicked: I needed them gone, and fast.

Because of my drive to destroy my debt (and my husband’s enthusiastic support), our student loan balances fell rapidly in the few years after that.

Our story lies in sharp contrast to some doctors, who for whatever reason don’t even pay enough towards student loans to keep the interest at bay, leading to ballooning student loans even after school is over and income is plentiful.

My Last Day of Student Debt

That day was TODAY!!!

MY STUDENT LOANS ARE GONE.

$347,634 (plus interest) repaid in full. No tricks, no secrets, no bailout from family members or forgiveness from the government.

Getting rid of that much student debt would be exciting enough of its own, but let’s add that total to the business debt I’ve repaid on my practice (which in my mind all goes under the larger category of “professional debt” in my life), and we get $847,634 of loan principal that has been wiped out!

It’s been 5.5 years since I graduated.

A Note to My Fellow Doctors With Lots of Student Debt

If I can do this, you can too.

I am not a major outlier in what I make as a doctor, and I have no other secret income pouring in. I work part-time in a high cost-of-living area. My husband is a middle school math teacher.

We aren’t super frugal; we live a very comfortable life and we spend a lot of money on non-essentials. We have a mortgage and two kids and we travel quite a bit.

While this post is admittedly self-congratulatory, I also hope it can be encouraging.

If you have a truckload of student debt, please know that you are not alone, nor are you fated to languish under your debt for decades.

You are the same intelligent, capable person who put in years upon years of hard work to be in the top of your high school class, your college class, and maybe even your doctoral class. You’ve passed incredibly rigorous board examinations. You’ve obtained a degree and license that is just a dream for thousands of people.

You are in control of your personal finances.

If fast and efficient debt repayment is what you want, GET AFTER IT.

It’s worth every penny.

4 Replies to “Goodbye, Student Loans!”

Woohoo! Thanks for sharing. I’ll be joining you at this celebration in three months 🙂

CONGRATS, Jason! I’ll be looking forward to reading your post/posts on that milestone. 🙂 And congratulations are also in order on everything you’ve accomplished in business and writing over the past few years. Thanks for sharing so much of your journey – it’s been awesome to watch! 😀

Congratulations on tackling the student loan monster! I find myself in exactly the same situation. Funny that the amount of debt is also the same! Graduated last year and just started working two months ago. (Took a little break to have a baby and loans were on deferment.) Now the payment starts by the end of this month and I am in the process of refinancing them all. Picking up 20 year term just because want to keep the monthly payment to a minimum.

Thank you, Kirat!!! Congratulations yourself on your graduation and on your baby! 🙂 It sounds like you already have a good plan in place, but if you want any more info on my refinancing experience this post may be useful: http://doctorindenim.com/faqs-on-student-debt/

Thanks so much for commenting, and good luck with everything! 😀