Game of Loans

You may recall that our effort to tackle things a little differently than the mainstream includes trying to destroy a huge amount of student debt within 5 years of finishing school. That 5-year mark for us will be at the end of this year. For the sake of comparison, the average student loan repayment time for those with a completed degree is about 21 years.

How much is “a huge amount,” you ask? I’m sure I could figure out the exact dollar amount if I tried, but my best estimation without having to make several long phone calls to the Department of Education is that my total student loan debt peaked between $220k and $230k. This gargantuan amount of red happened even with me graduating undergrad with no debt, working through all of my pre-doc school years, working for one year before going back for residency, and doing one year of paid residency. We also eventually cashed out a retirement account of my husband’s to help pay for my second residency. Without these factors in play, my debt would have been quite a bit higher.

To give you some perspective: Average student debt for an MD is ~$170k. For a DDS without specialty training it’s ~$250k. For my speciality it’s around ~$400k. It takes some serious effort to get rid of those sorts of debts quickly, even if you are lucky enough to have an awesome job with a solid income.

We do hear a lot of objections to our approach: “You can make more in the stock market than your student loans cost you in interest, you can try for loan forgiveness, you can do income-based repayment, you don’t want to put life on hold just to get rid of student debt, you’re going to have mortgage debt for decades anyway so what’s the big deal, etc.”

You can read about some of our responses to said objections here.

We don’t begrudge anyone their own rationale and strategy with student debt. Everyone should do their own math and then take action based what is best for their own unique situation and goals. But with each passing day we just feel more strongly about wanting our student debt gone.

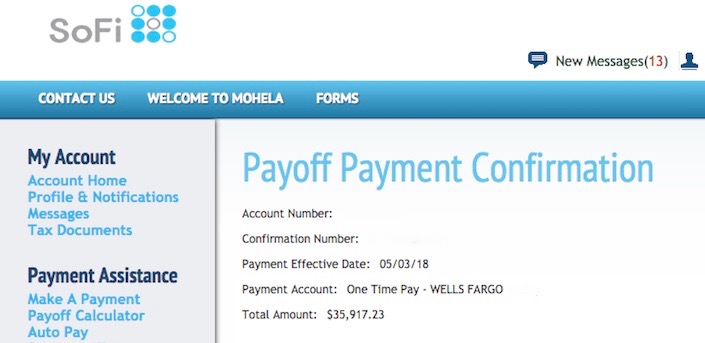

So here we are. Six months-ish from our self-imposed loan repayment deadline. And our second-to-last student loan group just kicked the bucket:

Yes, we had a decent experience with SoFi. No, I never read my “secure messages”. And yes – knowing everything else I could have done with that money – I still think hitting that “Pay Now” button was worth every penny.

2 Replies to “Game of Loans”

Wooohooo! Congrats!

THANK YOU! 😀