FAQs on Student Debt, Loan Forgiveness, and Refinancing

Okay friends, I’m starting to get questions about student loans pretty frequently from my fellow doctors. It’s some version of “Good for you for getting your student debt under control and all, but WTF am I supposed to do about mine?”

Usually the more detailed questions go something like the following, so let’s go through them one at a time and I’ll do my very best to answer in a reasonably helpful way:

How did you decide what to do about your loans?

Great question!

Here’s why we decided to destroy our student loans, as well as the update on our progress from May of 2018.

But of course you can’t (and shouldn’t) make all your decisions based on my story. Talk to as many doctors as you can, preferably those who have graduated recently who can feel your student loan pain. Get their stories. Get their ideas. Ask them how they feel about their current debt situation and about whatever path they’ve chosen to deal with it.

Then set your own long-term financial goals (including all debt-related goals) using the “SMART” goals process that we’ve discussed before. (SMART goals are Specific, Measurable, Actionable items for which you are Responsible and Time-bounded.)

Should I seek loan forgiveness?

In my opinion (and this is my opinion only), not unless you truly have no other options.

I personally have no faith that the current “forgiveness” programs will do what they are supposed to do for people in 10-25 years. The idea of my loans growing larger and larger for a decade or more – and thus my personal finances getting more wildly out of my control with each passing year – is not my cup of tea. Not to mention that the best case scenario includes me getting hit with an enormous tax bill at the time of that “forgiveness” based on whatever astronomical tax rate will apply to me in the future.

You can read this entertaining and informative post about loan forgiveness from Bobby Hoyt at Millennial Money Man, who has spent much more time thinking about this topic than I ever will. (If you enjoy his writing, browse around his blog for lots of good info on student loan management.)

Assuming you really do need or want extra help with your loans, I’m a much bigger fan of loan repayment programs than I am of loan forgiveness programs (where you actually get money to repay your loans each year because you are working somewhere underserved, like in a public health clinic on a reservation).

If you’re still a student and know that you don’t want to deal with the headache of doctor-level student loans, by all means join the military in dental/medical school. Your 4-year commitment will be over in the blink of an eye, and you’ll be debt-free.

Should I refinance my student loans? If so, when? And which loans?

The short answer is: yes you should refinance, if refinancing will help you meet your loan payoff goals more quickly and effectively! This means you have to know what your loan payoff goals are, which many people don’t. Go back and re-read the paragraph above about “Smart Goals” if you still need to set your own.

If you have zero idea what loans you have and what the terms are and when you intend to have them repaid, you need to get that information in front of you before you start exploring refinancing.

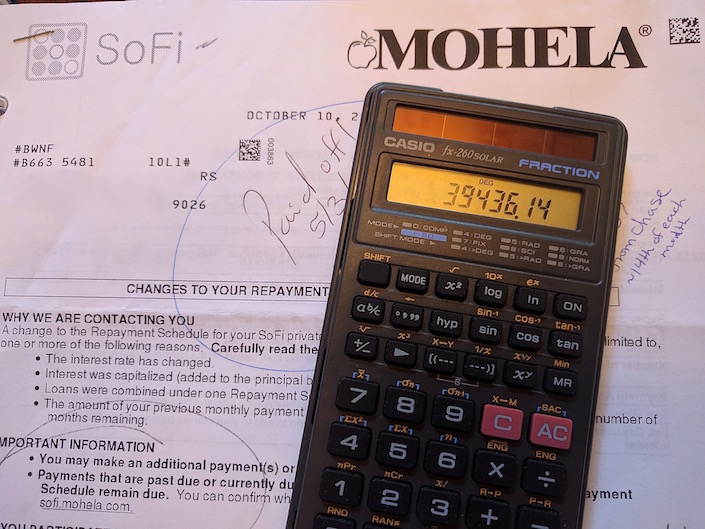

When you first look at your student loans and loan groups online, it may look something like this:

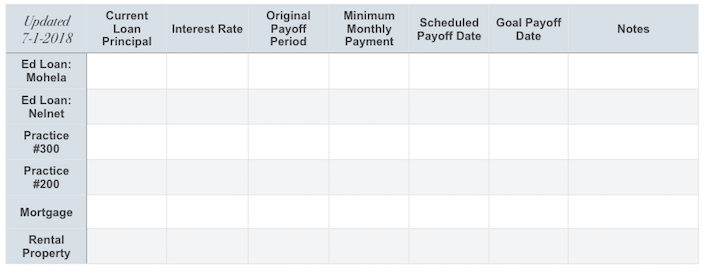

If you’re anything like me, it will be pages of stuff like that. I find these sheets to be very stressful and only marginally useful, which is I recommend you make your own chart like the one below and fit all the info you need in one place – preferably on one page. I recommend you include all debts – not just student debt – which will keep things in perspective as well as keep you motivated.

Personally, I like to keep hard copies of my various loan documents and my loan chart in a binder in my office. You should keep yours wherever you will look at them a lot and think about them a lot.

Done making your own chart? Good. That handy chart will help you know what to do with which loans – and the proper timing of it – once you have a refi offer in hand.

So now you can call a few refinancing companies and see what you are eligible for. Have them take a look at all your student loans, and tell you what they can offer you. Compare the offers to your chart and decide where you will benefit from refinancing and where you won’t. Pay special attention to that “minimum monthly payment” column, as that is where refinancing can backfire quickly if you’re not paying attention.

I say “a few refinancing companies” on purpose, because I keep talking to people who have had a lot of their time wasted by refinancing companies, only to eventually be told they don’t qualify for any useful refinancing services. Don’t waste hours and hours of your time on this. Check around every 6 to 12 months, and see if any better deals are available for you than what you currently have.

After that, put those loan repayments on auto-draft and forget about it for a while. Your time is better spent working hard and getting rid of your student loans entirely ASAP than fretting about a 0.5% reduction in interest that you were denied.

Rules that served me well for my refinancing:

Say no to refinancing fees/origination fees/service fees.

Say no to pre-payment penalties no matter what.

Learn how to use a basic amortization calculator so you can better understand and compare loan terms.

Do not let anyone take a lien on your practice or other important assets in order to refinance your student loans.

No matter how much you read about student loans on this site or any other site and no matter how much you talk to loan counselors or financial advisors or other smart people, it’s incredibly important that you read all of the fine print on any new documents you sign and understand exactly what your obligations are in your specific situation.

What if I refinance my loan and lose some of the “safety net” features I have with my current loan, like being able to go into forbearance if I get injured or ill?

That shouldn’t be a problem if you have proper disability insurance, which you absolutely should because you are an adult and a doctor. However, as mentioned above, read the fine print and only do what works for you in your situation.

Should I get a variable rate loan?

In my opinion: absolutely not.

I can get a lower rate with a co-signer! Should I have my spouse or parents co-sign?

Not unless you want them stuck with your debt if you die. If you go this route, best to make sure you have some pretty generous life insurance and make your co-signer the primary beneficiary.

Who did you refinance with?

Sofi/Mohela, and that was only for a portion of our student loans (they couldn’t beat the terms on some of my original loans from dental school). I heard about Sofi through this article by the ever-helpful Mr. Money Mustache. No complaints.

Did you refinance more than once?

Nope. We’ve kept our ears open for significantly better deals, but haven’t heard of any that would work for us. We’ve just been focused on wiping out our loans.

Should I buy a home, start a family, and/or invest elsewhere while repaying student loans?

Once you have actually figured out your long-term financial plan (and agreed on it with your spouse/partner if applicable), you will be able to know for sure whether it’s time to make other big life changes. A few important points along these lines:

If you’re not sure if you should rent or buy, you need to keep renting. Renting is not the bane of success. And buying a house will cost you way more than the sticker price.

If you’re not sure if you should have kids, you should not. If you do decide to have kids, remember that kids are not as expensive as society wants you to believe.

If you have your disability/life insurance and emergency fund all set and you know your long-term financial plan, I think getting other investments rolling while repaying student debt is great. We certainly have done it that way, and most other doctors I know have too. I like to think of debt repayment and investment as all part of the same goal of increasing our net worth. Note that I said “increasing net worth” and not “increasing income.” More on this important distinction later.

Is your life totally lame because all you’re doing with your money is repaying debt and investing?

Nah, I think our life is pretty kick-ass. Although our 12 year-old will be happy to explain to you all the reasons he thinks we are lame.

Okay then how are you doing all of the above things on a part-time work schedule, and how do you keep track of it all?

Here are the short answers:

We keep the lines of communication about money (including our debts) wide open. It’s a topic for anytime, anywhere. Yes, we talk about it in front of the kids.

We look carefully at all of our debts (including investment debts) every 6 months, and honestly asses our progress (or lack thereof) as well our future goals and the timelines of those goals. We use that handy loan chart above and update it every 6 months.

(If you’re unsure what loans you have floating around out there, you need to spend some quality time looking at your own credit report and on the phone with the Department of Education.)

We have a non-budget.

We track our spending down to the penny. The way you feel about your money changes when you have to stare at exactly where it goes every month.

We keep our life overhead low, especially relative to our peers and especially for living in a high COL area. This is what allows us to have the part-time work schedule that we’ve enjoyed ever since school ended and to stay true to our commitment to real work-life balance.

Our mortgage is less than 10% of our gross take-home pay (while many “experts” tell you 28-36% is what you can “afford”). We have no car payments, we pay less than $100/mo total on car insurance, and frequently go for days without even using our cars.

We don’t spend very much money on our kids. In case you didn’t catch it above, here’s how we got ready for our newborn last year for less than $350. And here’s a post about our approach to the kids’ birthdays.

We have real skills besides the ones we use at work.

We have inexpensive, healthy hobbies. Running and hiking cost nothing. Biking and backpacking and skiing cost next to nothing if you take care of your gear properly.

We travel for free.

And that’s about all I can come up with for today, friends. I hope it was helpful or at least mildly interesting. Still have questions about student loans? Feel free to message me or leave them in the comments! Even if I can’t answer them myself, I can probably point you in the right direction.