Hacking a 41-Day Family Vacation

Remember that post I wrote about how we’re not selling everything to see the world? I admit that our plans for next summer sound a lot like we’re doing just that. But we’re not – we promise.

…

Remember that post I wrote about how we’re not selling everything to see the world? I admit that our plans for next summer sound a lot like we’re doing just that. But we’re not – we promise.

…

The ever-popular topic of “How much does travel cost?” is back!

An acquaintance of mine was just asked about how she and her husband paid for their family’s 5-star, multi-month, international vacation. Fair question, I think, since they’ve been pretty public about how long and fancy the trip was. Her response was: “It’s not about money! It’s about our dreams! It’s about having faith!”

*Insert sound of me choking on coffee.*

…

As you may already know, we got a quite a few awesome questions after sharing some details on the oh-so-taboo topics of our personal finances. You can click here for all the “money” posts (haha).

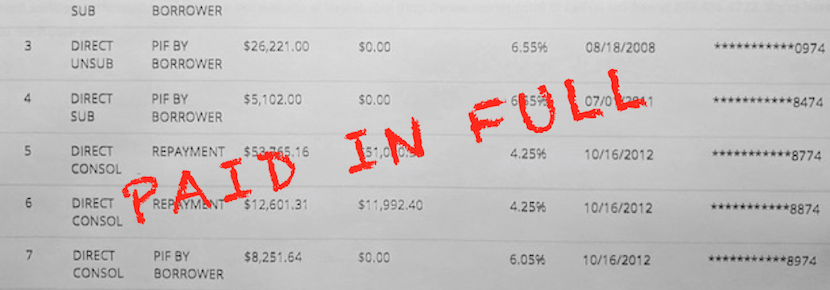

If you don’t want to read any of that but need a quick re-hash: we spent less than $80k in 2018 including all those fancy trips, we hit the milestone of repaying $500k in business loans in February, and in April I paid off the last of my gargantuan student loans. Yipee!

Anyway, several of the questions/ comments we’ve had about money things have been related to cost of living, which I did my best to address in my last post.

Before we get to the main topic of this post (fancypants lifestyles without a doctor’s income), let me address three comments that keep coming up in various forms: …

Wow, those last couple posts about money brought a few haters out of the woodwork!

In case you missed them, I’m talking about the post sharing our family’s spending in 2018 and the post about paying off my student loans.

I got a bunch of readers who were super supportive and enthusiastic, which was unexpected and very much appreciated. I got many a “Congratulations!!!” message about the student loans, as well as a lot of great questions about the details of our lifestyle and debt repayment.

It was overall really fun to share all that information with the internet world.

In February of this year, I made some calls to the lovely folks at the Department of Education and Student Aid and confirmed that from 2005 to 2013 I took out almost $350,000 IN STUDENT LOANS!

The exact total amount of money I borrowed for school – including tuition, fees, supplies, and “cost of living” funds – was $347,634.

That total is principal only and includes none of the interest accumulation, which was quite significant over the course of all those years.

The loans were dispersed between 2005, when I started dental school, and 2013, when I finished my specialty residency.

I had no debt coming out of undergrad, which I finished in 3 years at an in-state university. I got an academic scholarship and worked two jobs during college. And before that I went to a public high school and worked at a bakery, in case anyone is keeping score.

My husband and I are now on our 18th winter of driving non-fancy 2WD cars in snowy climates. Locations we’ve driven said cars during winter include most of Colorado, Chicago and other “lake effect snow” parts of the Midwest, and our current mountainous hometown, which averages 100 inches of snow per year in town (double that on the higher mountains around us).

This past winter brought us one storm with over 35 inches of snow in 24 hours.

Our current vehicles are both 2WD. They were made in 2004 and 2007, were bought with cash, and cost us less than $100/mo total to insure. The costs for gas and regular maintenance (oil changes, etc) are negligible.

…

Yes, I took that picture of the shark. No, I was not in the water with it (aquariums for the win), although I am proud to say I have snorkeled with sharks a couple of times. A shark picture seemed appropriate for a post about taxes and credit cards; they all are potentially scary, and they are frequently misunderstood.

So last month I put $24,130 of our personal taxes on a credit card. You read that right. The same person who tracked her family’s spending down to the penny last year, bought her kids second-hand toys for Christmas, and advocates super aggressive debt repayment just put tens of thousands of dollars of money she owed to the government onto a credit card! …

Honestly, it’s mind blowing for me to write this post. I have major imposter syndrome anytime I even think about numbers this high.

And before we go any farther: please don’t send me messages telling me I’m limiting myself by “not thinking big” or some such nonsense. These are freaking huge numbers. And not only on a global scale (where the median household income is under 10k) but in the USA as well (where the median household income is about $61k) and even in the shiny bubble of doctor salaries that I live in, where the average individual income is anywhere from $100k to $300k depending on your specialty and time in practice and blah blah blah.

So, yes, it feels crazy to write this post. It’s also really fun for me to write this post, because I’ve been waiting impatiently for this day ever since I realized it was within my grasp this calendar year. …

A couple quick notes before we dive in to the numbers:

I decided back in January of 2018 to share our family’s spending publicly for a whole year. This was an attempt to prove that doctors do not have to spend a totally ridiculous amount of money to live well and love life and more importantly a strategy to make us take a cold hard look at where all our cash was going and decide whether we liked what we saw. …

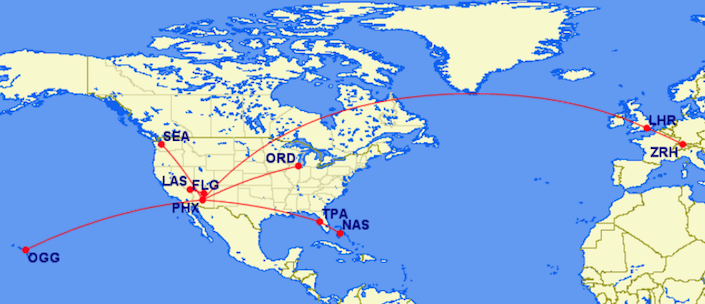

This is where travel hacking took us in 2018:

Not too bad, especially considering Baby J couldn’t get a passport until late last year. Below you’ll find our total costs and savings from all those trips, listed by month of the year. …