Living a Fancypants Life Without a Doctor’s Income

As you may already know, we got a quite a few awesome questions after sharing some details on the oh-so-taboo topics of our personal finances. You can click here for all the “money” posts (haha).

If you don’t want to read any of that but need a quick re-hash: we spent less than $80k in 2018 including all those fancy trips, we hit the milestone of repaying $500k in business loans in February, and in April I paid off the last of my gargantuan student loans. Yipee!

Anyway, several of the questions/ comments we’ve had about money things have been related to cost of living, which I did my best to address in my last post.

More From the Peanut Gallery

Before we get to the main topic of this post (fancypants lifestyles without a doctor’s income), let me address three comments that keep coming up in various forms:

“I could never make that much!”

Well…. Yeah. You are probably right that you are never going to make “that much” with the attitude that it’s impossible, whatever amount you’re talking about.

The same principal holds true for any accomplishment – be it financial, athletic, or personal – if you are convinced you can’t do it, you’re probably right.

If you ever decide you do want to set a goal of making “that much” some day, let me know and I’ll point you to some seriously awesome resources on personal and professional growth.

“I can’t live like that on minimum wage!”

You are correct that $80k per year is probably not an appropriate amount of spending if you are making minimum wage.

If you are making minimum wage and you are older than 17, I highly recommend the financial advice offered by Dave Ramsey. And also review this infographic in detail.

“Must be nice to be a doctor!”

This comment usually seems to be semi-sarcastic in it’s delivery, so I’m not super sure what to do with it.

It is (on most days) nice to be a doctor. But I wasn’t always one, and it didn’t just happen to me like a lightening strike. I used to make minimum wage too.

Every job has its pros and cons, but if you want to be a doctor I have great news: the schools I went to are all still accepting applications! Assuming you have a high school degree and some semblance of a work ethic, you’re only 10-12 years of 80-hour weeks – plus about 6 years of massive debt repayments – from where I am now.

High Income Without the Doctor Degree

What about those commenters I mentioned before who are saying things like “I’m fine with a little bit of hard work, but being any sort of healthcare worker is definitely not for me. What are my options to get that sort of lifestyle?”

Such a good question! Depends somewhat on the situation, right? Let’s dive in to a few of the most common ones (bearing in mind that this sort of question is presumably coming from people my age or younger, since most people older than me are past the point of considering career options).

Is the person asking the question…

Single Without Kids?

If you are single and living in the first world with no dependents, you’ve got a heck of lot of options available to you.

First, get fit and stay fit – physically and mentally. This will probably include saying “yes” to working out when you would rather be asleep and saying “no” to things like over-use of alcohol. It will also mean limiting your social media intake (gasp!) and enlisting the help of various health professionals when needed.

Second, do not start a family – in any form – until you are truly ready. Divorce is one of the biggest money-sucks out there, so stay single until you are sure you’ve found the right person for you. Get a prenup if you want to. Do everything possible to avoid reproducing until you (and your partner, if applicable) are actually capable of mentally, emotionally, and financially handling the responsibilities that come along with being an involved, caring parent for at least 20 years.

Third, don’t assume you need a college degree and don’t blame other people if you already have a useless one. If you do choose to pursue higher education, remember that not all degrees are created equal and that in most cases a degree from Fancy Name School will do no more good for your future than the same degree from State School, but it will put you much farther into debt. Only put the time and money in for a high-end degree or specialized training if it will give you monetarily valuable skills and not smother you in debt.

Fourth, don’t overspend on your housing or vehicle (and no financing a car, ever). In fact, get yourself some roommates and ditch the car completely when you can.

Fifth, surround yourself with people who support and encourage the healthy life choices listed above. Life is too short to spend your precious time defending your good decisions to the haters (and there will always be haters).

Married Without Kids?

Pretty much everything from the above category applies here, except that you need to include your spouse in major decisions.

You have the power of two incomes and nothing else going on, so get to the career/income level that you want to achieve – no excuses.

Please do not acquire kids, dogs, or even a beta fish until you are self-sufficient with a reasonable plan for your financial future and proper insurance coverage.

Married With Kids?

What if you are already in our family situation – married with kids?

In order to have $80k to spend you’re going to need to net $40k each, average. There are a lot of jobs out there that pay $50k (even without college degrees). So let’s say you both get one of those, and your effective tax rate with those two adorable munchkins and a household net of $100k might be around 10%… You’re looking at around $90k to take home.

Check. That. Out. You can put $10k in retirement savings and STILL spend about $80k a year.

Remember that babies are not as expensive as people think, and having kids does not mean you suddenly need to let yourself get out of shape, or blow a ton of money on things like birthday parties, major holidays, or vehicle upgrades.

Single-Income With Kids?

This one gets a smidge trickier than living on a single income without kids, but it’s far from impossible. Plenty of families do it and do it beautifully (including some of our closest friends).

(Note that I am only talking about single-income households, not presuming either way whether that would also be a single-parent household.)

If you don’t have the option of being a dual-income household and you have or want kids in the mix and you want to be able to spend like we do, the reality is that someone is going to need to bring in that $100k (or close to it).

Unless you get quite lucky in a poker game or a rich uncle dies and leaves you scads of money, bringing in six figures per year is going to take some hard work, probably for a prolonged period of time.

If healthcare is not your jam, consider law, engineering, architecture, real estate, IT work, or specialized electrical, plumbing, welding, or mechanical work. Many people in those fields make close to or over $100k (and not all of those positions will require traditional 4-year degrees).

There are plenty more examples out there. Start researching today, and find one that’s a good fit for you.

Location, Location, Location!

No matter what life stage or family situation you’re in, realize that moving is one of your options. I have lived in a whole lot of places in my adult life, mostly because I needed to in order to chase the career that I wanted. I’d be willing to bet that most people who have great careers have uprooted themselves more than once in pursuit of their goals.

That $80k we spent last year in our little corner of the American West would go much farther in dozens of other cities in this country (where our incomes would be the same or higher) and it would go even farther in many other countries.

If you are a US citizen, you have access to 50 states and hundreds of diverse cities without even showing a passport. You could load up a truck and drive to a new place tomorrow if you wanted to. Don’t let the enormity of that privilege be lost on you, and take advantage of it if it can help you meet your financial goals.

Luxury is in the Eye of the Beholder

I wouldn’t feel right ending this post without a reminder that if you have drinkable water coming out of your tap, you are already rich compared to many, many people on this planet.

Don’t fall prey to the age-old trap of thinking more is better. Figure out what “enough” is for you, and be happy there.

We do not live a particularly glitzy life compared to some, and there are lots of “gurus” out there who would tell us we should be making more and spending more at this point in our lives.

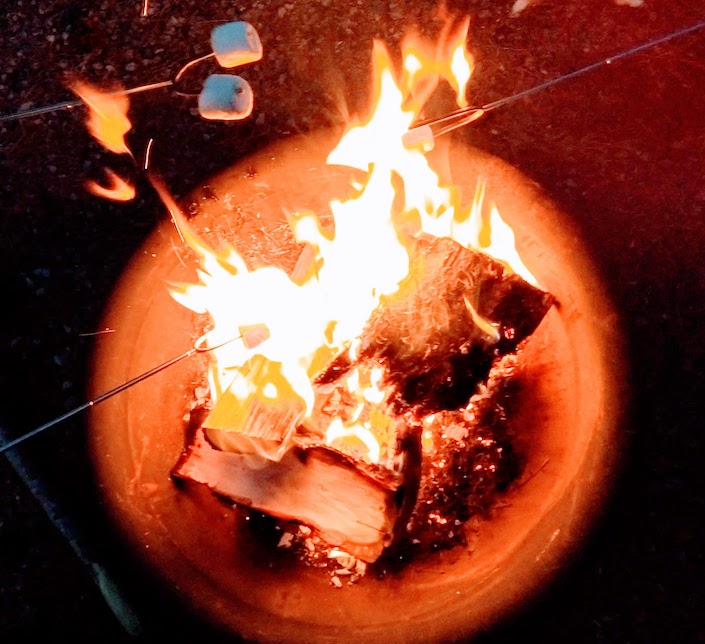

But we get to live in an awesome place, we keep ourselves in good shape, and we get lots of time off to chase outdoor adventures with our kids.

That is luxury.