Used Biking Gear and Other April Spending

Holy cow it’s mid-May! So it’s well past time to sum up what we spent in April.

A quick reminder: these spending reports are an effort to keep myself accountable to the idea that doctors do not have to spend a totally ridiculous amount of money to live well and love life. And while many people are happy to acknowledge that doctors over-spend, very few doctors are actually up for sharing their personal spending (not that I blame them – putting all this out there in public is an odd experience). That being said, we’re big believers in transparency. As a bonus, looking at our spending this critically makes us really have to evaluate if we’re putting our money where our values are. So we’re trying to do these spending reports for every month of 2018.

If you’re interested, check out our spending reports for January, February, and March.

As I may have mentioned before, we do not do traditional budgeting. You absolutely should do traditional budgeting if that works for you as a way to control your spending. More on this topic here.

Notes About These Numbers

-I have not included our charitable giving here, which can be a very sensitive subject for a lot of people (especially those who feel like they are drowning in debt). But unless you yourself are about to starve or freeze to death due to lack of basic resources, I recommend you find at least one charitable organization you are really excited about and send them monthly donations via auto-draft, even if it’s a small amount. Many charities desperately need people who can commit to monthly financial support.

-This list does not include our HSA, stock investments, or our real estate investments. I am planning to write more about how we approach our savings and investments at some point.

-This list does not include business loan payments, professional dues, licensing fees, malpractice insurance, or other expenses that are due exclusively to our business ownership and – unlike my student loans – would go away if I sold the business and switched careers.

-The student loan payment shown here is what’s on auto-draft and it is FINALLY significantly lower than what it was in January!!! You can read here about how we are paying extra on our loans every month in an effort to be done with them this year. I include student loans in “home” spending even though they are related to my career because they don’t go away no matter what I do career-wise.

-We have health insurance and an HSA though my husband’s work as a teacher, both of which are deducted directly from his paycheck. It’s actually a pretty great deal, all things considered. We pay out of pocket for dental care and eye care services as needed.

-All “Entertainment/Dining” expenses are 100% optional expenses. For us, these tend to be things like going to the movies and eating at Chick-fil-A.

-I include life and disability insurance in this list even though they are sort of related to work, because they are what protect our current lifestyle. My disability insurance is expensive because it is important to us to be able to pay off all our debts and live well even if I am unable to work.

-“Groceries” includes food, household items, medications, and toiletries purchased at Sam’s Club or grocery stores or Walgreens.

-I have separated baby formula out because it is a significant expense that will not apply to everyone and will (I really hope) go away in a few months for us. All other baby-related expenses are included in “Grocery/Pharmacy”. You can read about how we got all ready for our baby for less than $350 here.

-This list does not include at-home babysitters, who we occasionally pay in cash to watch our kids. Any at-home babysitters we pay are non-essential, although very much appreciated. The daycare/childcare shown is what we pay for while we are both at work (which is very much essential as long as we both want to work) and is listed under “Daycare/Childcare”.

-“Daycare/Childcare” is a bit higher this month because of the the after-school care that we sent Little C to – just because we had a lot going on and he thinks it’s fun. It’s a bargain at ~$3/hour.

-Baby J’s neck finally got reasonably strong, so we bought a used bike trailer and bike seat!!! We are SO excited to get back to our full-time bike commuting (aka No Car Days) that used to be such a huge part of our spring/summer/fall.

-The category called “$ Earned by Little C” is what our 11 year-old earns by doing things like reading out loud for the family and doing miles on the treadmill ($0.20 per mile). We don’t do a traditional allowance.

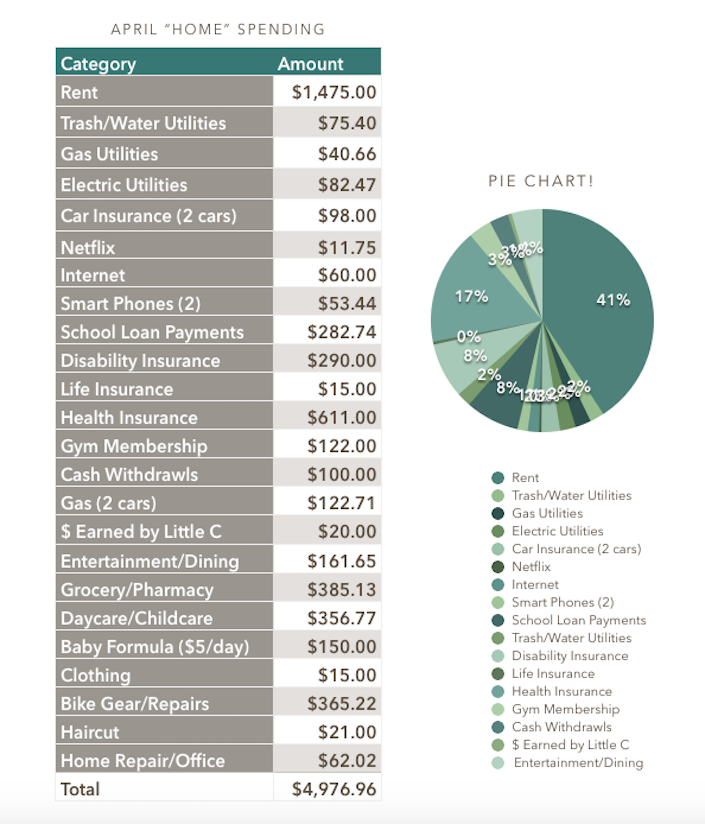

Without further ado, here is our home/family spending for April of 2018, in the form of the sophisticated screenshot from a Numbers document that you’ve come to expect:

That total is $4,976.96. Huzzah!

I was pretty excited to see that April has been our least spendy month so far in 2018, despite being full of fun activities and unnecessary gear nerd purchases. This lower monthly spending is logistically helpful too, since we are trying to buy a house and also trying to build a rental property on a lot that we own in another city (which has thus far done nothing but cost us a bunch of money for “weed clearing” due to fussy city regulations). More on both of these adventures later.

In the meantime, please note that the above number – $4,976.96 – multiplies by 12 to $59,723.52, implying that we could live a kick-ass, heavily-insured life in this gorgeous high-cost-of-living town with two kids for an entire year for under $60k. This is important for two reasons: 1. Because people keep complaining that frugality and early retirement plans are out of their reach and only work if you are a young single male and never want a family. My good friend Mr. Computer Engineer had a great response to that here (scroll down to “Common Objections”). 2. Because even though being willing to change locations can be a huge part of a successful financial game plan, I want people to understand that living in a high COL area does not cause any of your money to evaporate.

I’ll conclude with a fun picture of us on a hike near our above-mentioned weed-free lot, because springtime in the desert is freaking amazing: