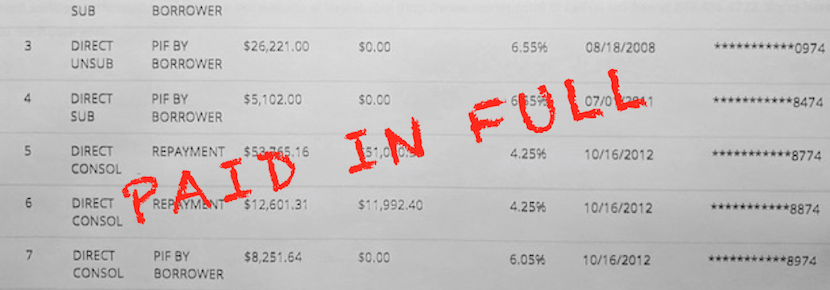

In February of this year, I made some calls to the lovely folks at the Department of Education and Student Aid and confirmed that from 2005 to 2013 I took out almost $350,000 IN STUDENT LOANS!

A Brief History of My Loans

The exact total amount of money I borrowed for school – including tuition, fees, supplies, and “cost of living” funds – was $347,634.

That total is principal only and includes none of the interest accumulation, which was quite significant over the course of all those years.

The loans were dispersed between 2005, when I started dental school, and 2013, when I finished my specialty residency.

I had no debt coming out of undergrad, which I finished in 3 years at an in-state university. I got an academic scholarship and worked two jobs during college. And before that I went to a public high school and worked at a bakery, in case anyone is keeping score.

…

Read More Read More