Hiking Gear, Bike Repairs, and Other May Spending

A quick reminder: these spending reports are an effort to keep myself accountable to the idea that doctors do not have to spend a totally ridiculous amount of money to live well and love life. We’re trying to do these spending reports for every month of 2018.

As I have mentioned before, we do not do traditional budgeting. You absolutely should do traditional budgeting if that works for you as a way to control your spending. More on this topic here.

Notes About May

May seemed to be an explosion of spending money, and not just because we purchased a house (which we consider to be a separate endeavor from our month-to-month spending). You can read the details about the money part of the house purchase and the move here.

There were graduation gifts to buy. The arrival of hiking season meant we wanted a legit hiking backpack to carry Baby J around in. Biking season got into full swing which meant that C damaged not one but two mountain bikes beyond what we could fix with the tools in our garage. We were paying two sets of utility payments while we moved from one house to the other. Spending all over the place. Somehow, as you’ll see below, this month’s spending wasn’t far off our 2018 trend.

If you’re interested, check out our spending reports for January, February, March, and April.

Notes About The Numbers

-I have not included our charitable giving here, which can be a very sensitive subject for a lot of people (especially those who feel like they are drowning in debt). But unless you yourself are about to starve or freeze to death due to lack of basic resources, I recommend you find at least one charitable organization you are really excited about and send them monthly donations via auto-draft, even if it’s a small amount. Many charities desperately need people who can commit to monthly financial support.

-This list does not include our HSA, stock investments, or our real estate investments. I am planning to write more about how we approach our savings and investments at some point.

-This list does not include business loan payments, professional dues, licensing fees, malpractice insurance, or other expenses that are due exclusively to our business ownership and – unlike my student loans – would go away if I sold the business and switched careers.

-The student loan payment shown here is what’s on auto-draft. You can read here about how we are paying extra on our loans every month in an effort to be done with them this year. I include student loans in “home” spending even though they are related to my career because they don’t go away no matter what I do career-wise.

-We have health insurance and an HSA though my husband’s work as a teacher, both of which are deducted directly from his paycheck. It’s actually a pretty great deal, all things considered. We pay out of pocket for dental care and eye care services as needed.

-All “Entertainment/Dining” expenses are 100% optional expenses. For us, these tend to be things like going to the movies and eating at Chick-fil-A.

-I include life and disability insurance in this list even though they are sort of related to work, because they are what protect our current lifestyle. My disability insurance is expensive because it is important to us to be able to pay off all our debts and live well even if I am unable to work.

-“Groceries” includes food, household items, medications, and toiletries purchased at Sam’s Club or grocery stores or Walgreens.

-I have separated baby formula out because it is a significant expense that will not apply to everyone and will go away this summer for us. All other baby-related expenses are included in “Grocery/Pharmacy” or sometimes “Clothing”. You can read about how we got all ready for our baby for less than $350 here.

-This list does not include at-home babysitters, who we occasionally pay in cash to watch our kids. Any at-home babysitters we pay are non-essential, although very much appreciated. The daycare/childcare shown is what we pay for while we are both at work (which is very much essential as long as we both want to work) and is listed under “Daycare/Childcare”.

-“Home Repair/Painting” spending probably overlaps with some of the spending I noted in the post about the costs of moving (and some of the supplies eventually got returned), but that all got difficult to separate out so I went with the higher numbers in an effort to be more transparent about the whole thing.

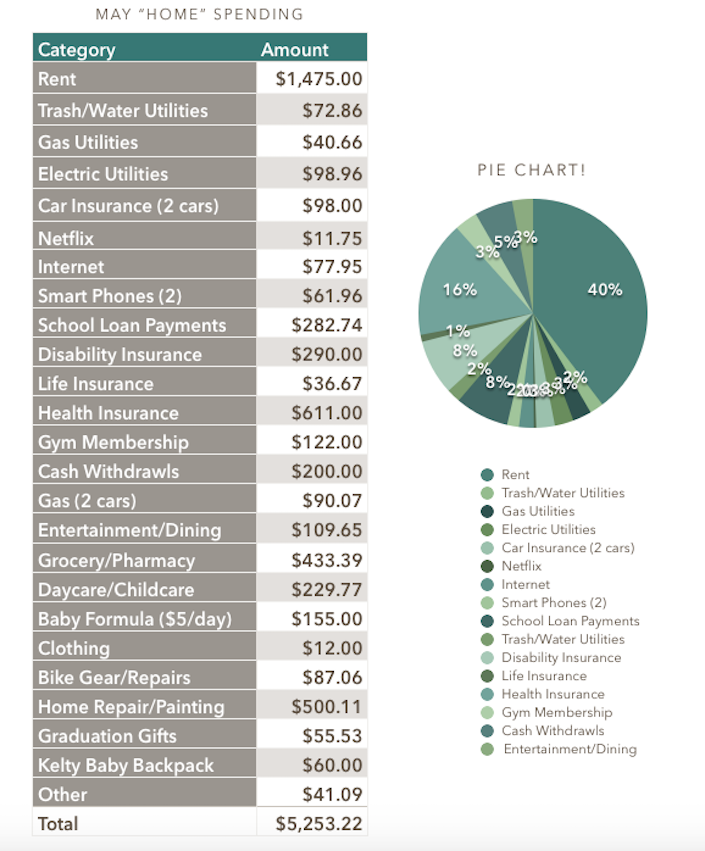

So here is our home/family spending for May of 2018, in the form of the sophisticated screenshot from a Numbers document that you’ve come to expect:

That total is $5,253.22. I don’t have much commentary on this right now because moving makes one very tired. So we’ll end with a pic of the Kelty carrier in use, which is a purchase I am much more excited about than the house:

4 Replies to “Hiking Gear, Bike Repairs, and Other May Spending”

Enjoying these spending reports! Thanks for sharing real numbers!

Thanks for commenting, and glad you’re enjoying these posts! It’s been really illuminating for me to be sharing these numbers every month! 😛

Interesting looking at your spending info for a family with kids. Is your daycare cost unusually low?

Hi Brad! Yes, I think it is. The most we’ve paid for a month of daycare this year is a little over $700, which is below the national average. We got very lucky with our daycare.