A Desert Wedding, an Epic Race, and Other September Spending

We’ve somehow made to the end of 3rd Quarter, tracking every dollar we’ve spent this year (scroll to the bottom of the post for the total numbers)!

A quick reminder: these spending reports are an effort to keep myself accountable to the idea that doctors do not have to spend a totally ridiculous amount of money to live well and love life. We’re planning to do these spending reports through the end of 2018.

As I have mentioned before, we do not do traditional budgeting. You absolutely should do traditional budgeting if that works for you as a way to control your spending. More on this topic here.

Notes About September

September was another expensive month, mostly because our weekend at the Imogene Pass Run cost us more than booking our holiday trip to Switzerland did (as icing on the cake, the race was also much more difficult than visiting Switzerland is expected to be). The main cost during the race weekend was a fancy private vacation rental near the finish line that we paid for by check, and our travel hacking hobby didn’t help us out much on that one. Race registration costs were included in June spending.

Still, we had an absolute blast at the race and the costs of training and the race weekend itself were more than worth it (read our “Tips for Endurance Racing as a Busy Parent” here).

Later in the month, my brother got married in the Valley of Fire in Nevada, and we celebrated afterward at the Cosmopolitan on the Vegas strip. This trip, fortunately, was largely covered by hotel points.

If you’re interested, check out our spending reports for January, February, March, April, May, June, July and August. June’s report contains totals for the half-year mark as well.

Notes About The Numbers

-I have not included our charitable giving here, which can be a very sensitive subject for a lot of people (especially those who feel like they are drowning in debt). But unless you yourself are about to starve or freeze to death due to lack of basic resources, I recommend you find at least one charitable organization you are really excited about and send them monthly donations via auto-draft, even if it’s a small amount. Many charities desperately need people who can commit to monthly financial support.

-This list does not include our HSA, stock investments, or our real estate investments. I am planning to write more about how we approach our savings and investments at some point.

-This list does not include business loan payments, professional dues, licensing fees, malpractice insurance, or other expenses that are due exclusively to our business ownership and – unlike my student loans – would go away if I sold the business and switched careers.

-The student loan payment shown here is what’s on auto-draft. You can read here about how we are paying extra on our loans every month in an effort to be done with them this year. I include student loans in “home” spending even though they are related to my career because they don’t go away no matter what I do career-wise.

-We have health insurance and an HSA though my husband’s work as a teacher, both of which are deducted directly from his paycheck. It’s actually a pretty great deal, all things considered. We pay out of pocket for dental care and eye care services as needed.

-All “Entertainment/Dining” expenses are 100% optional expenses. For us, these tend to be things like going to the movies and eating at Chick-fil-A.

-I include life and disability insurance in this list even though they are sort of related to work, because they are what protect our current lifestyle. My disability insurance is expensive because it is important to us to be able to pay off all our debts and live well even if I am unable to work.

-“Groceries” includes food, household items, medications, and toiletries purchased at Sam’s Club or grocery stores or Walgreens.

-This list does not include at-home babysitters, who we very occasionally pay in cash to watch our kids when Grandma isn’t available (Grandmas are the best!!!). Any at-home babysitters we pay are non-essential, although very much appreciated. The daycare/childcare shown is what we pay for while we are both at work (which is very much essential as long as we both want to work) and is listed under “Daycare/Childcare”.

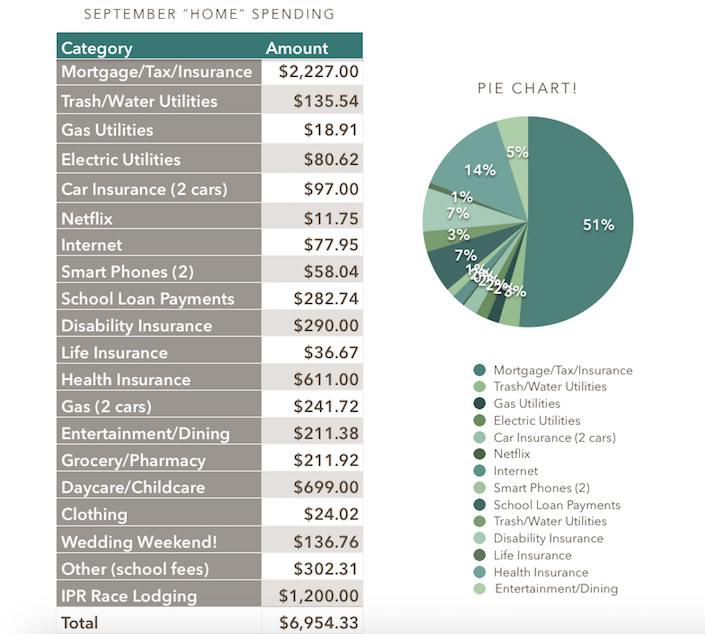

So here is our home/family spending for September of 2018, in the form of the sophisticated screenshot from a Numbers document that you’ve come to expect:

That total is $6,954.33.

If we had not done the IPR race, which was just a six-hour drive and two nights in an expensive town (the largest single expense this month aside from our mortgage), that total would have been well below $5,700.

Our total spending for the first 3 quarters of 2018 is $55,047.20, for a family of 4 in a high COL location.

This assumes we can count the initial costs of buying our house (down payment, closing costs, etc.) as either an investment or a savings account (we lean toward the latter, although we have no beef with anyone who wants to call their primary home an investment).

Please also note that even though our mortgage is a HUGE percentage of our spending this month – and most months for the foreseeable future, actually – it is far less than that if looked at as a percentage of our income. I would not recommend anyone spend close to half of their net income on a mortgage, ever. If you’re not in a position to take on a mortgage, remember that there is nothing wrong with renting or having roommates!

Also note that the student loans are still on track to be paid off in December! Whoooohooooo!

4 Replies to “A Desert Wedding, an Epic Race, and Other September Spending”

Since you’re tracking spending so carefully, have you looked into geothermal heating and cooling? Geothermal heat pumps are super-efficient and they provide clean energy…

Hi Lowell! I’ve read about it, but I’m not aware of geothermal heating/cooling being available in our area yet. Looking forward to watching that technology advance! I am all for clean energy! 😀

I’m really working on keeping track of the complete details of my spending, including all receipts. Maybe I’ll be better after my nursing training is done. Thanks for the inspiration!

Reyna, congrats on your nursing training! That’s so cool! And good luck with your goal of tracking spending – it’s always a challenge. 😀 Thanks for reading and commenting! 🙂